Summary

This note goes through the concept of contribution margin on a per unit basis, as a simple way to think about a Company's profitability. This will then be applied to specific business profiles in future notes.

Setting the Scene

Let’s imagine a hypothetical scenario with two companies:

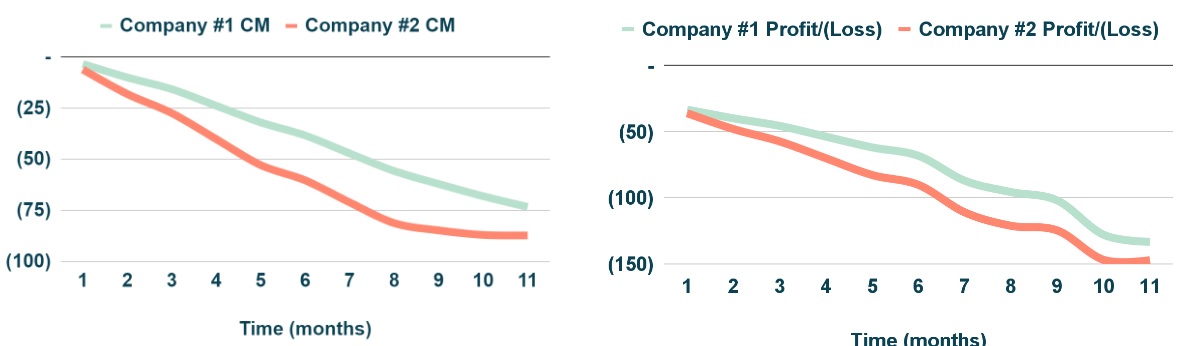

- From a revenue perspective, both companies have exactly the same revenues and growth profile.

- From a contribution margin and a profit/(loss) perspective, Company Two’s financials are slightly worse.

Figure 1: Contribution margin and losses for two companies.

Figure 1: Contribution margin and losses for two companies.

Contribution Margin per “Unit of Cost”

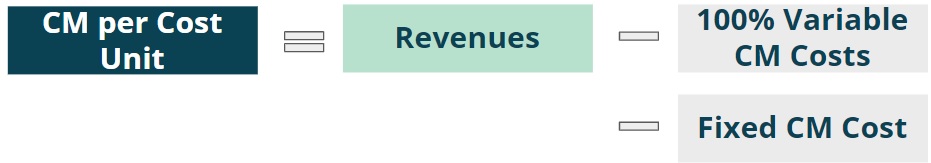

The first step is to split CM costs in two buckets: (i) 100% variable regardless of revenue level and (ii) fixed costs up until a certain revenue level.

Figure 2: CM cost buckets.

Figure 2: CM cost buckets.

The second step is to then analyse each bucket independently:

- Fixed CM costs: the company pays for this cost within a certain capacity figure linked to revenues. For example, it could be the salary of a sales person. The agent can bring in up to a certain revenue level; every month the revenue generated changes but the salary paid remains the same. This is a simplification, as in practice there are several “Fixed CM costs”, each incurred for up to a certain revenue level.

- Variable CM costs: this could be for example an agreed % of revenues paid out as bonus to sales agents. Given that it is variable, it protects margins and therefore profitability whenever there is a decrease in revenues. However, it cannot be so high that nothing is left for the Company.

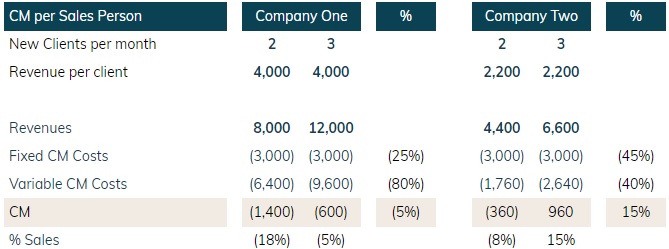

Figure 3: CM per sales person for Company 1 and Company 2.

Figure 3: CM per sales person for Company 1 and Company 2.

- Fixed CM costs: given the higher revenue per client, Company One has an advantage over Company Two (25% vs 45% of revenues).

- Variable CM costs: it is very clear that Company One’s costs are simply too high at 80% of revenues (vs 40% for Company Two).

Even with a more favourable position from a fixed costs perspective,

it will be impossible to become profitable, given that for each sales person

(or unit cost), Company One has a loss of (£600-1,400). If they add more

sales people, revenues will grow but the loss will only become worse over time.

It is very interesting to notice that many times important questions about a business’

profitability can be determined using a few key numbers. It is not necessary to use a complex spreadsheet

to draw conclusions.

Digging out of a Hole

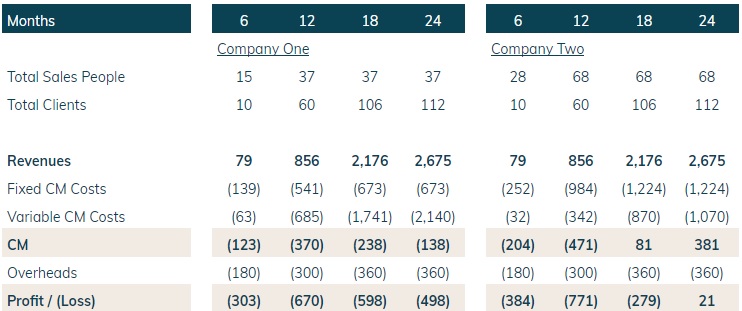

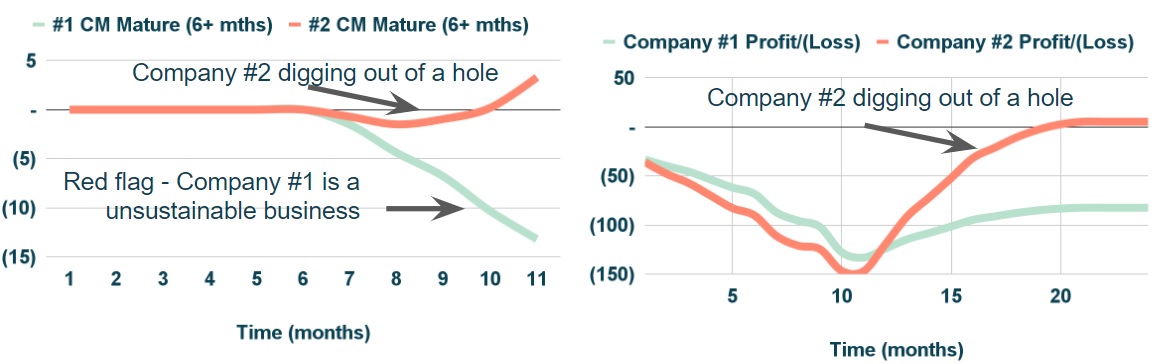

Coming back to the previous example, over a 24 months period, both companies grew their revenues at exactly the same pace (from £79k to £2.7m) but the CM profile was completely different. By month 12, one would think that Company Two was in trouble but in fact a few quarters later, it managed to grow CM to cover Overheads.

Figure 4: Key indicators and financials for Company 1 and Company 2.

Figure 4: Key indicators and financials for Company 1 and Company 2.

Based on the previous section, this is not a surprise, as Company One made a loss of (£600-1,400) per sales person per month, while Company Two was digging out of a hole (see figure below) as it grew its revenues and CM, as the number of sales people increased.

Figure 5: Company Two is digging out of a hole.

Figure 5: Company Two is digging out of a hole.

Conclusion

Contribution margin on a per unit basis is a very powerful way to think about a Company's profitability. It simplifies everything and makes it easier to have key insights about a business. More to come on this in future notes.