Summary

On a previous article, I wrote: “If [finance] is instead spending >50% of

their time producing numbers (pillar #3) there is something wrong.”

A leader of a Finance Team, I think it is of paramount importance to

ensure that the people working with me produce work that is as valuable as

possible for an organisation.

This means being ruthless and automating as many manual tasks as possible, so that they can use their time on more value-added tasks that will help them to develop as professionals and have a more meaningful role. After implementing some of the things below, people in my team avoid each week two hours of manual work. Over the last two years, this has saved them more than two-hundred hours. I am very proud of this.

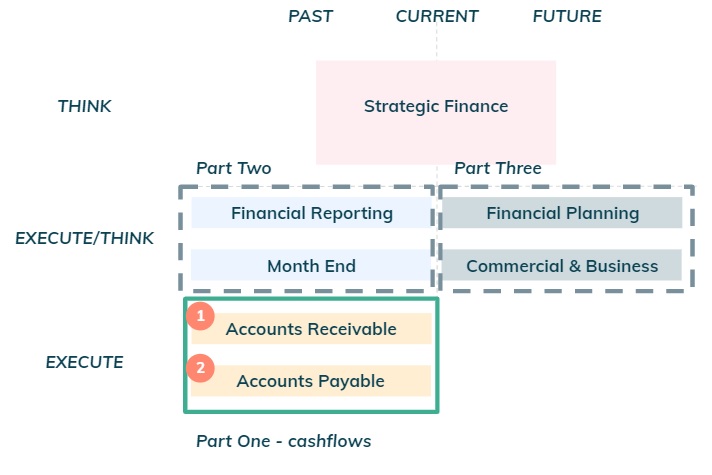

Therefore I thought it would be of value to go through day to day finance tasks and how to automate them to minimise time spent producing numbers. This is the first note of a series of three notes. Part one goes through a detailed overview of the operations relating to cashflows for a young startup (series B or earlier).

Figure 1: Series of three notes.

Figure 1: Series of three notes.

Part two and three will cover respectively Financial Reporting and Financial Planning.

Part One: Cashflows

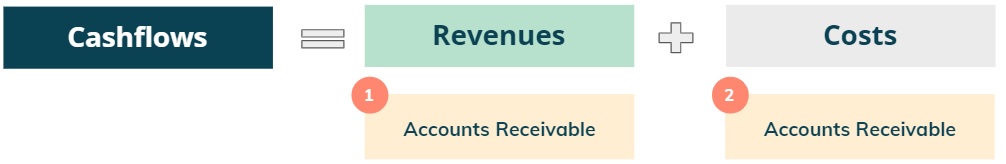

We are going to drill down on finance tasks relating to Accounts Receivable (“AR”), i.e. inflows to be received from clients and Accounts Payable (“AP”), i.e. outflows to be paid to suppliers.

Figure 2: Accounts Receivable and Accounts Payable.

Figure 2: Accounts Receivable and Accounts Payable.

Cashflows are thus equal to cash inflows from clients relating to revenues net

of cash outflows paid to suppliers relating to costs.

A common source of mistakes in

numbers is to represent both as positive numbers and subtract them; to avoid this,

one should represent cash inflows as a positive number (e.g £100) and cash outflows as

a negative number (e.g (£20)) and then ADD both numbers to get to cash flows (£80 = £100 + (£20)).

Day to to day finance: Accounts Receivable

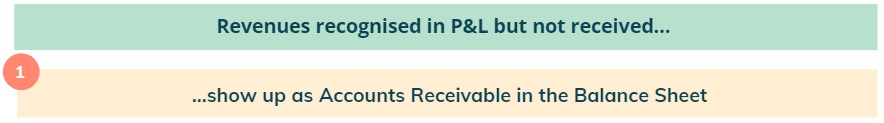

Whenever there is revenue earned, there will be an invoice sent to a

client requesting payment for a service or product. This is then

recognised in the P&L statement.

Accounts Receivables (“AR”) relates to

client invoices for which payment has not been received yet. These show up as a

current asset in the balance sheet (i.e. cash inflow expected to be received soon).

Figure 3: Accounts Receivable concept.

Figure 3: Accounts Receivable concept.

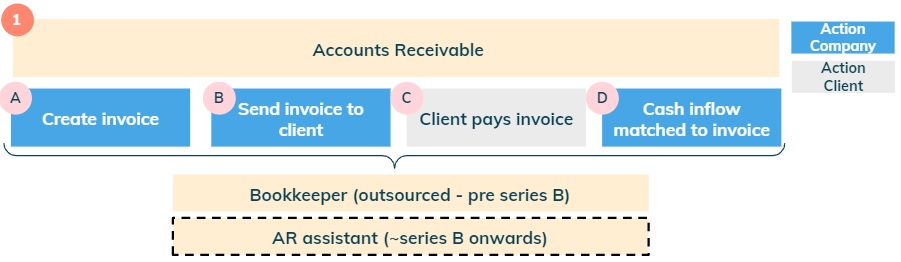

Operationally, it will be the bookkeeper's responsibility to do the bookkeeping (i.e. recognise revenues in the accounting system), generate an invoice, send it to the client and match the cash inflow to the client invoice.

Figure 4: Accounts Receivable operational steps.

Figure 4: Accounts Receivable operational steps.

Steps A and B: For simple applications, the following spreadsheet

(AR automatic emails for invoices) automates sending an email with an invoice to a client

using a google apps script (see appendix for details).

Accounting systems such as Xero or Quickbooks are better suited to automate steps A and B above,

however this will break above a certain volume of invoices (likely fine for up to hundreds per month),

different currencies and number of legal entities.

Step C: Clients do not always pay on time, so it is common to use Xero or Quickbooks to chase payments automatically for this step (there are plenty of options for this).

Step D: The accounting system will receive the bank feeds for each operational bank account. The bookkeeper will manually match an inflow to an invoice (there are startups trying to automate this...).

Day to to day finance: Accounts Payable

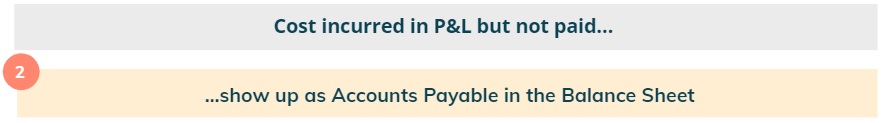

Whenever there is a cost incurred, there will be an invoice received from a supplier

requesting payment for a service or product. The amount will be recognised in the P&L

(unless it was already accrued for in the past).

Accounts Payable (“AP”) relates to unpaid supplier invoices. These show up as a current

liability in the balance sheet (i.e. cash outflow expected to be paid soon).

Figure 5: Accounts Payable concept.

Figure 5: Accounts Payable concept.

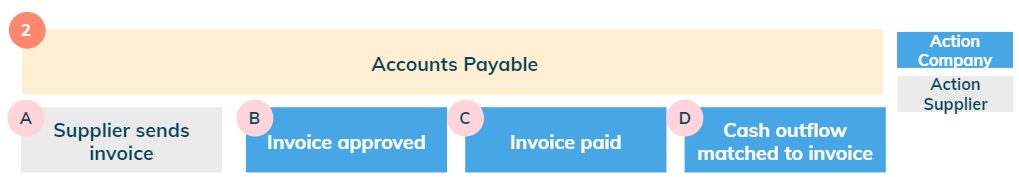

The operational steps to pay invoices are illustrated below, however there is an additional complexity required for steps B & C below that should be automated to save time.

Figure 6: Accounts Payable operational steps.

Figure 6: Accounts Payable operational steps.

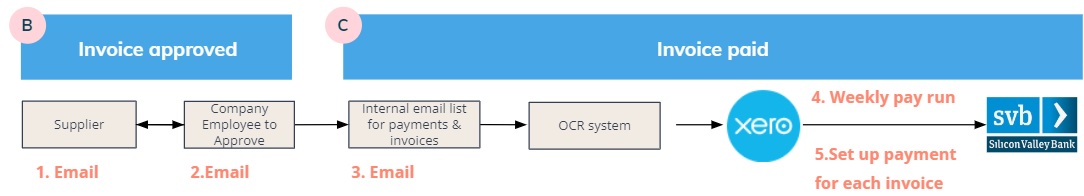

First let's lay out the process that requires improvement.

Figure 7: Detailed operations to approve and pay invoice.

Figure 7: Detailed operations to approve and pay invoice.

- Step 1: supplier sends an invoice to an employee at the Company (the one that requested the service or goods). In some companies, this is sent to directly to Finance who then needs to figure out who should approve it internally. This wastes a lot of time.

- Step 2: the employee may exchange several emails with the supplier if there are mistakes in the invoice. Again, this wastes a lot of time.

- Step 3: the employee then forwards the approved invoice to an email

distribution list, which forwards emails to an Optical Recognition System (OCR) to digitalise the invoice.

This is then pushed to the accounting system (Xero below in this example) by the bookkeeper.

- There is a risk that unapproved invoices are sent to the accounting system as the OCR as no checks in place for emails received (it accepts emails from anyone!). Even worse, they may actually end up being paid.

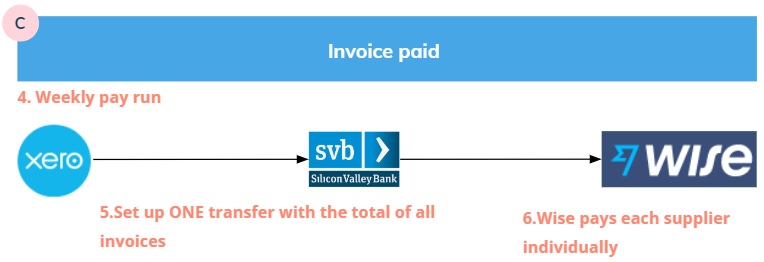

- Step 4: there is typically a weekly pay run to pay approved invoices on their due date.

The bookkeeper needs to email an approver the payments due and request approval to set up payments.

- This is not great from a cashflow perspective, as some invoices get paid ahead of their due date (e.g Friday payrun would include all invoices with due dates up until the following Thursday)

- Step 5: there is one payment set up in the online banking system, for EACH invoice. This is very time consuming.

- Step 6: Bookkeeper sends an email to an approver to release the payments. The approver then needs to login to an online banking system and release each payment. You guessed...Time wasted again.

Overall this process will take many email exchanges and lot of time wasted. There is a much better way to do this.

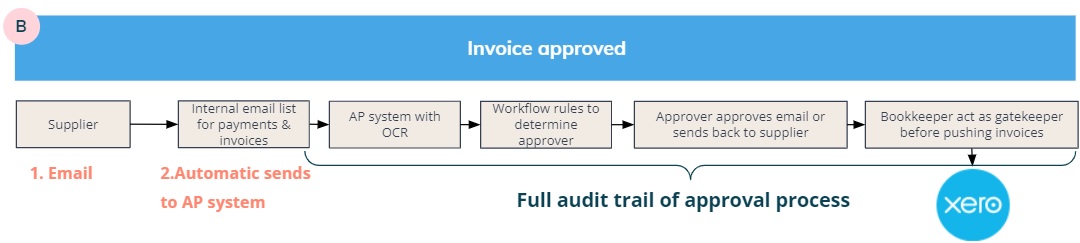

Now let's lay out a much better process, that is almost fully automated. Let's start

with the process of approving the invoice (step B).

Figure 8: Fully automated process to deal with approving invoices.

Figure 8: Fully automated process to deal with approving invoices.

- Step 1: supplier sends an invoice to an email distribution list. This contains an email to an AP system (link here for what I use - Corpay One) that deals with the OCR.

- Step 2: AP systems automatically upload invoices to the platform.

- Step 3: AP systems allow to set up workflows based on different rules which are used to automatically determine the Approver of the invoice. Everything is automated and no time is wasted by finance or company employees.

- Step 4: Once invoice is approved it goes to the bookkeeper. If the invoice is rejected

the supplier is notified automatically.

There is NO risk that an unapproved invoices get sent to the accounting system or paid. So much better. - Step 5: Bookkeeper acts as a gatekeeper to any information sent to the accounting system. If all fine, it pushes approved invoices into the accounting system. Lot's of time saved.

Figure 9: Almost fully automated process to deal with paying invoices.

Figure 9: Almost fully automated process to deal with paying invoices.

- Step 6: Accounting system used to automatically provide information to Wise on all invoices to be paid (payment details and amount).

- Step 7: One transfer set up to pay the full amount of invoices to be paid.

- Step 8: Once funds are received at Wise, it automatically pays each supplier individually.

The final step to fully automate the process is to make payments from the AP platform (this will be available in a near future).

If you require support or have any questions my contact is:

Appendix - AR automatic emails for invoices

Make a copy of the spreadsheet before following the steps described further below.

Figure 10: Make a copy of the spreadhseet.

Figure 10: Make a copy of the spreadhseet.

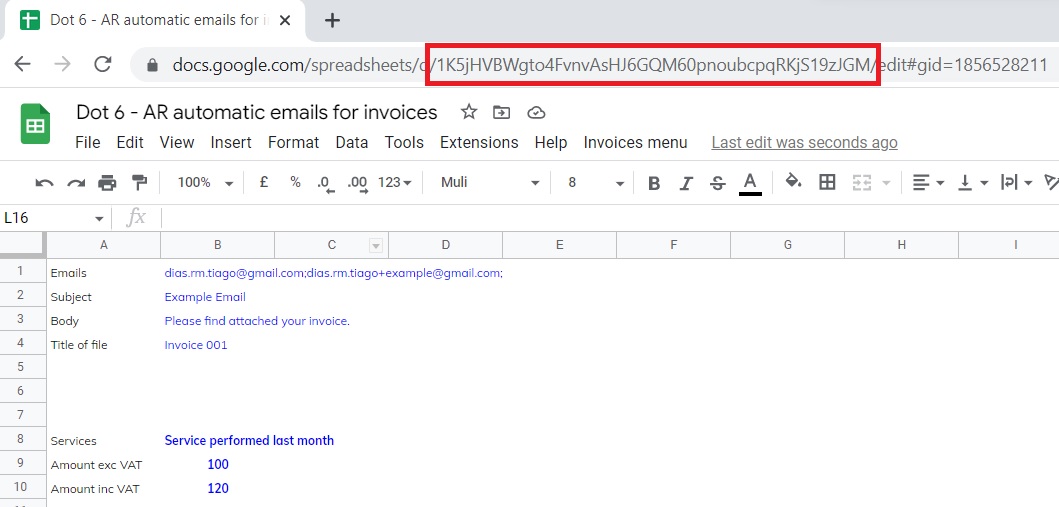

- Step 1: Go to the URL and copy the spreadsheet ID to a word doc.

For my example it was

“1K5jHVBWgto4FvnvAsHJ6GQM60pnoubcpqRKjS19zJGM”

Figure 11: Get spreadsheet ID.

Figure 11: Get spreadsheet ID.

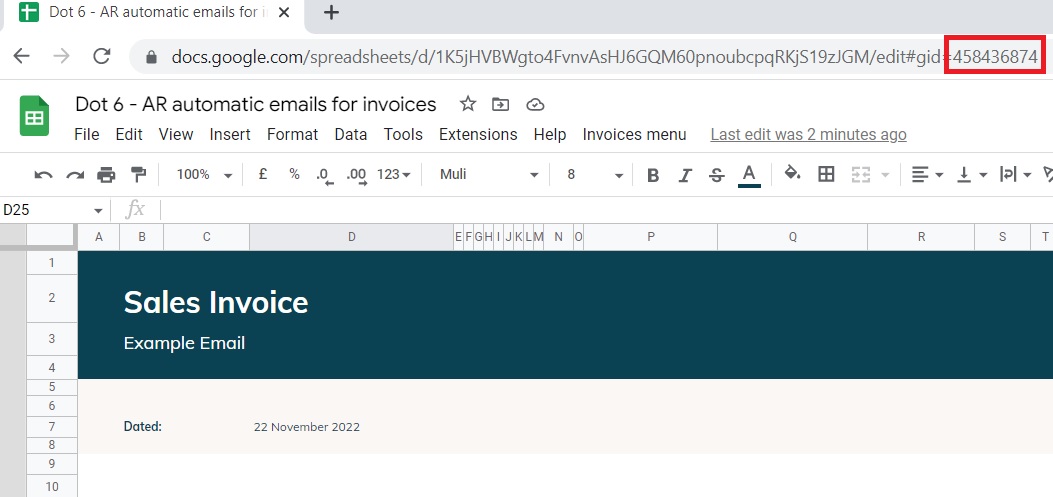

- Step 2: Select the “Ouput” tab then copy the tab ID to a word doc. For my example it was “458436874”

Figure 12: Get tab ID.

Figure 12: Get tab ID.

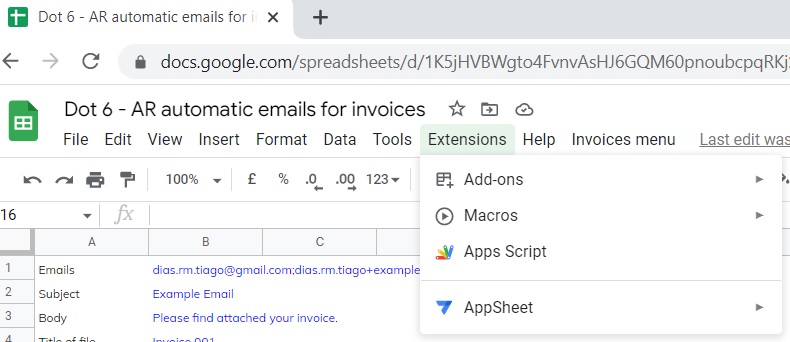

- Step 3: Go to extensions and click “Apps Script”. On the first time the script is run you will need to authorise access.

Figure 13: Access Apps Script.

Figure 13: Access Apps Script.

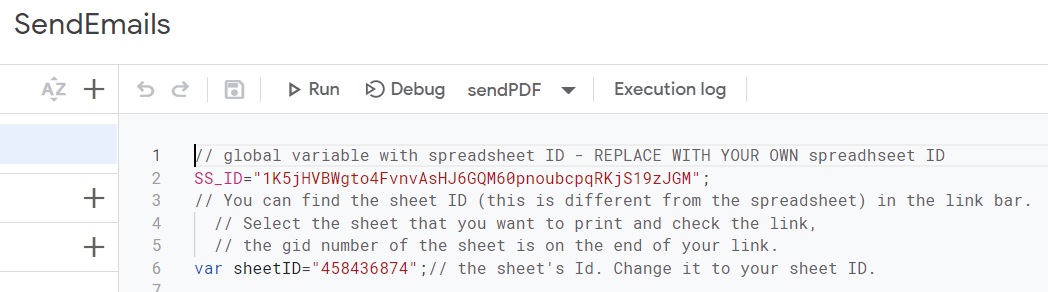

- Step 4: Update the “SS_ID” and the “sheetID” with the details specific to your spreadsheet.

Figure 14: Update spreadsheet and tab information.

Figure 14: Update spreadsheet and tab information.

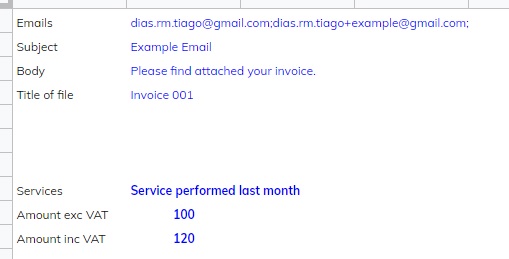

- Step 5: Update the contacts and invoice details.

Figure 15: Update contact and invoice details.

Figure 15: Update contact and invoice details.

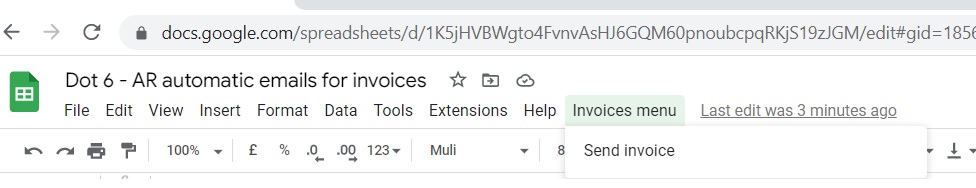

- Step 6: Go to invoices menu and click “Send invoice”. The script then runs and sends an email with an invoice attached as a pdf.

Figure 16: Send invoice.

Figure 16: Send invoice.

An invoice is sent to the recipient - see example below (link here).

Figure 17: Example email.

Figure 17: Example email.